|

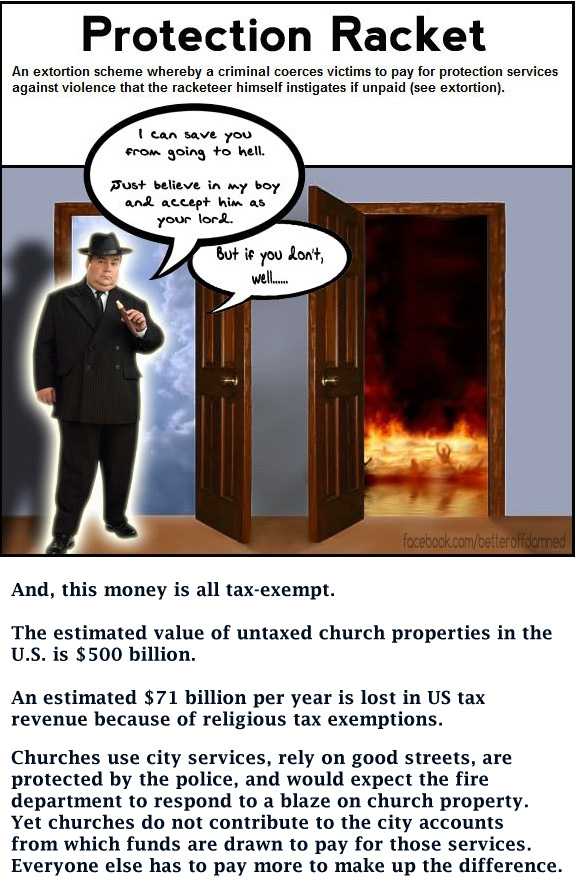

Exemptions from property taxes represent an even larger benefit to churches.

There may be as much as $100 billion dollars in untaxed church property in

the United States. This creates a problem, according to some, because the

tax exemption amounts to a gift of money to the churches at the expense of

tax payers. For every dollar which the government cannot collect on

church property, it must make up for by collecting it from citizens; thus

all citizens are forced to indirectly support churches, even those they

do not belong to and may even oppose.

Unfortunately, this indirect violation of the separation of church and state may be necessary in order to avoid a very direct violation of the free exercise of religion. The taxation of church property would put churches more directly at the mercy of the government because the power to tax is, in the long run, the power to control or even destroy. By removing church property from the power of the state to tax, church property is also removed from the power of the state to directly interfere with. Thus, a hostile government would find it more difficult to interfere with an unpopular or minority religious group. Small local communities sometimes have bad track records with showing tolerance towards new and unusual religious groups; giving them more power over such groups would not be a good idea. Nevertheless, none of that changes the fact that property tax exemptions are a problem. Not only are citizens forced to indirectly support religious organizations, but some groups benefit much more than others, resulting in problematic religious favoritism. Some institutions, like the Catholic and Mormon churches, have billions of dollars in property whereas others, like the Jehovah's Witnesses, own much, much less. There is also, unfortunately, the real problem of fraud. Some people tired of high property taxes will send away for mail-order “divinity” diplomas and claim that, because they are now ministers, their personal property is exempt from taxes. The problem got to be enough that in 1981, New York State passed a law declaring mail-order religious exemptions to be illegal. Even some religious leaders agree that the property tax exemptions are problematic. Eugene Carson Blake, a former head of the National Council of Churches, complained once that tax exemptions ended up putting a greater tax burden on the poor who could least afford it. He feared that one day, the people might turn against their wealthy churches and demand restitution. The idea that wealthy churches have abandoned their true mission also bothered James Pike, a former Episcopal bishop in San Francisco. According to him, some churches have become much too involved with money and other worldly matters, blinding them to the spiritual calling which should be their focus. Some groups, like the American Jewish Congress, have made donations to local governments in place of the taxes which they do not have to pay. This shows that they truly are concerned with the entire local community, not simply their own members or congregation, and that they are interested in supporting the government services which they use. The Constitution does not require the government to exempt churches from federal income taxation or from filing tax and information returns. Requiring churches to file an annual information return does not offend either the Free Exercise Clause or the Establishment Clause [of the First Amendment].

Churches, Taxes, and Non-profits Note: The following is taken from here and pertains to the United States of America. We've all seen the argument here and elsewhere that religious organizations should be taxed. I was inspired to write this post after seeing this post, which seems to argue that the government is missing out on untold billions in tax revenue from churches, frontpage the other day. What you may not know about our tax system is that it really doesn't allow for the taxation of churches. Further, the advantages that churches receive unfairly are quite minimal. The purpose of this post is to explain why, and to more appropriately direct your anger where it belongs. Why don't they pay income tax? Well, we tax "INCOME". Our tax system is designed to tax the "income" of entities, be they people, groups, or corporations. When we are talking about corporate entities, the term "income" reflects profit (income - expenses), not gross sales. So if I own a company that makes no money, I'm not paying any tax even if I sold billions of dollars worth of products. The reason we tax corporate income is because that is what value passes to the owners, either in the form of direct payments (dividends) or reinvestment in the company which gives the owner's share in the company a higher value. WTF is a "non-profit"? "Non-profits" are entities that are not taxed because they create no profits. They still "make money" by selling things. For example, every time someone buys a ribbon sticker for their car supporting Autism Awareness or whatever, the organization selling it made money. But this money, while "income" for accounting purposes, is not really "income" for tax purposes. There is no law forbidding non-profits from acquiring wealth and holding it indefinitely. Non-profits don't have owners. There is no group of people buying and selling shares, and there is nobody waiting for a dividend. Non-profits have people who control their activity called "trustees". There are laws limiting the power of trustees to enrich themselves via the organization. Because there are no owners, all money made by the entity has to be spent within the entity, either on expenses or reinvestment. Since nobody can "sell" the non-profit, reinvestment doesn't represent an increased value to anybody. Non-profits DO have employees, some of whom are paid a shitload of money. There is no law saying that employees of non-profits have to be poor, and in many cases they aren't. Large, complex non-profits pay their executives very well. The University you attend/ed was probably a non-profit, even if the President lived on campus for free in a mansion made out of cash. A church by any other name...is a non-profit. What I just described above applies to churches and charities alike. Here is the Internal Revenue Code section governing tax exemption. Under 501(c), you can see a list of 29 types of organizations that receive tax-exempt status, all of which share the criteria set out above. Please note that these organizations are not required to engage in charity to receive the designation. 501(c)(3) and 501(d) exempts religious organizations. There is a bit in 501(d) about taxable income for religious corporations. Without getting into the nitty-gritty, this is a special circumstance that applies when churches engage in business for the direct benefit of members (who in this case are starting to sound like owners, right?), which is ultimately taxed. Even if you got rid of 501(d) and the mention of religion in 501(c)(3), any church would still find other statutes to fall under. How about 501(c)(7)? However, if a church doesn't qualify as a 501(c)(3) organization, then donations to it would not be tax-deductible. Churches enjoy several other tax benefits.

As for the parsonage exemption, There is actually a very interesting court case going on right now about it brought by the FFRF. So what should you be angry about? Oversight Remember when I said "There are laws limiting the power of trustees to enrich themselves via the organization"? Well that wasn't a lie, but there is a ton of abuse with little punishment. Of course, that's definitely not exclusive to churches - charities have always been havens for abuse. Our tax code in regards to non-profits is well written - it's the execution that leaves much to be desired. Many of the abuses you see are the result of the donors' and trustees' stupidity (as in the case of poorly-run organizations or where employees are overpaid - See: cash-mansion) or the lack of oversight (as in the case of trustees doing illegal things). Tax deductibility Someone who donates money to a 501(c)(3) organization can deduct that amount from taxable income before computing the tax on that income. The practical effect is that the federal government subsidizes these organizations. For example, if you itemize deductions, and are in the 25% tax bracket, a $1,000 donation to a charity reduces your taxes by $250, which is the same effect as if no deduction were allowed and you donated $750 while the government match 1/3 of your donation. In this way, the federal government's subsidy to charities in 2012 was $39 billion. The trade-off between allowing donations to a public charity -- including a church -- to be deductible, in exchange for the charity removing itself from the political process seems to be a fair one. Any 501(c)(3) organization is absolutely prohibited, directly or indirectly, from attempting to influence any public election on behalf of, or in opposition to, any candidate. However, "campaigning from the Pulpit" is frequently perceived to be a problem, especially in Presidential election years.

More people than ever before are non-religious, and we shouldn't have to subsidize a myth that we're not buying into If we levy taxes - sin taxes, they call them - on things that are bad to get people to stop doing them, why, in Heaven's name, don't we tax religion - a sexist, homophobic magic act that's been used to justify everything from genital mutilation to genocide? You want to raise the tax on tobacco so kids don't get cancer? Okay. But then let's put one on Sunday School so they don't get stupid. Want to know how dangerous fake news is? Two thousand years later and people still believe the virgin birth Jesus walked on water, turned water into wine, died, resurrected and ascended into heaven. No wonder fake news is so widespread. People will believe damn near anything. Happy fake holiday! |

Send comments to:

hjw2001@gmail.com

hjw2001@gmail.com

|