|

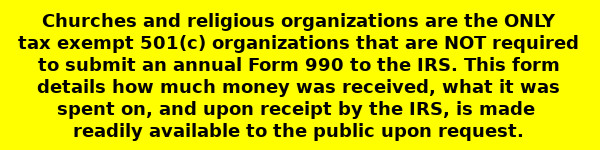

How to apply for tax exempt status

The term church is found, but not specifically defined, in the Internal Revenue Code. With the exception of the special rules for church audits, the use of the term church also includes conventions and associations of churches as well as integrated auxiliaries of a church. Certain characteristics are generally attributed to churches. These attributes of a church have been developed by the IRS and by court decisions. They include:

The IRS generally uses a combination of these characteristics, together with other facts and circumstances, to determine whether an organization is considered a church for federal tax purposes. Source: Publication 1828, Tax Guide for Churches and Religious Organizations. |

Send comments to:

hjw2001@gmail.com

hjw2001@gmail.com

|